The Canadian Government is always there for their citizens in all phases of their life, being it one of the saddest moments too. Yes, you read it write; Insurance companies ensure that your loved ones live a hassle-free life even a at the tie of your death or during funeral phase. For this, Canada has a scheme called as Funeral Insurance, which covers you from all the expenses related with funeral or burial.

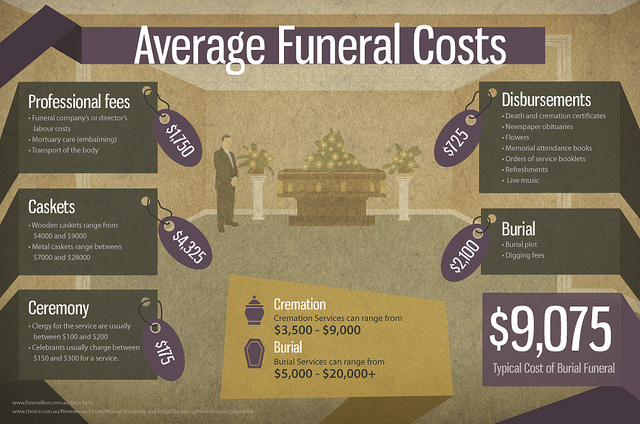

Nothing is immortal in this universe; everything that has existence today is going to die tomorrow, sooner or later. Death is one of the most certain things in life, but it brings a lot of emotional pain to our loved ones, family and relatives. With that, they also have to take financial pressure to make arrangements for the funeral. They have to settle all the bills related to funeral starting from a chapel to transport. To ensure that your family is free from this burden, you should take life insurance to cover these expenses. Usually funeral expense in Canada ranges between $6,000 – $10,000 which is born by your loved ones, family and relatives.

The coverages cited above are known as Funeral Insurance or Burial Insurance. They are taken by a person so it can cover his or her certain expenses related to death, including a funeral, cremation and burial.

How does it Work?

Funeral insurance is best suited for the person who is in the range between 40-80 years. It is very easy to obtain and it comes with different payout terms and condition. While taking it, you must consider how much funeral expense would be required by your family. Within 24 hours of claim, the amount is transferred to the beneficiary account. By this way, a lot of hassle and expenses are saved while funeral ceremony.

The best part is that you need not go for health checkup while taking this insurance; therefore, old people usually opt for funeral insurance. You just need to simply fill the form which has some specified question about your health but they don’t go for any medical examination. Hence, anyone can qualify for funeral or burial insurance. It also shows that many unhealthy people likely to opt for this insurance. Other best part comprises premium remains the same; it does not change with the time.

Funeral insurance is essential for people who are seeking to make sure that their funeral and burial expenses are borne by them, not by their loved ones. Funeral insurance is suggested for non-life insurance policy holder, as it covers expenses only related to the policy-holder’s burial and funeral. Policies can be drafted keeping a family member in loop or a funeral director, naming them as the beneficiary.

People don’t give much preference to such small things but taking funeral insurance make a very large impact in their toughest time when you are not there with them.